Maryland Express Services (MES) — MVA-Authorized Tag & Title

Maryland doesn’t always ask for a Bill of Sale — but when your price is low and the vehicle is newer, the MVA wants proof. Here’s exactly when you need it, when it must be notarized, and how to check the “book value” the state uses.

Buying or selling a used car in Maryland comes with a fun little mystery: some people say, “I didn’t need a bill of sale,” and others say, “The MVA sent me back to get it notarized.” Both can be true — because Maryland only requires it in certain situations.

This post explains those situations, gives you the official links, and shows you how to keep the MVA from taxing you on more than you actually paid.

When a Bill of Sale Is Required

You’ll need Maryland’s official Bill of Sale — Form VR-181 — and it must be signed by buyer and seller and notarized if all of the following apply:

- The vehicle is less than 7 years old.

- The sale price is $500 or more below the MVA’s “book value.”

- The buyer wants to pay tax based on the sale price instead of the state’s book value.

That bill of sale is how you prove to the MVA, “No, we really did sell it for that amount.” Without it, the state can ignore your price and use their number.

📄 Download the official MVA form: Maryland MVA Bill of Sale (Form VR-181)

When a Bill of Sale Is Not Usually Required

In a lot of normal private sales, the title alone is enough. That’s usually the case when:

- The vehicle is 7 years old or older; or

- The sale price is within about $500 of the book value.

In those situations, the MVA often accepts the properly assigned title (with sale price, date, buyer/seller info) and doesn’t ask for a separate notarized bill of sale.

But it’s still smart to have one — because it protects both buyer and seller if anything is questioned later.

Why the Notarization Matters

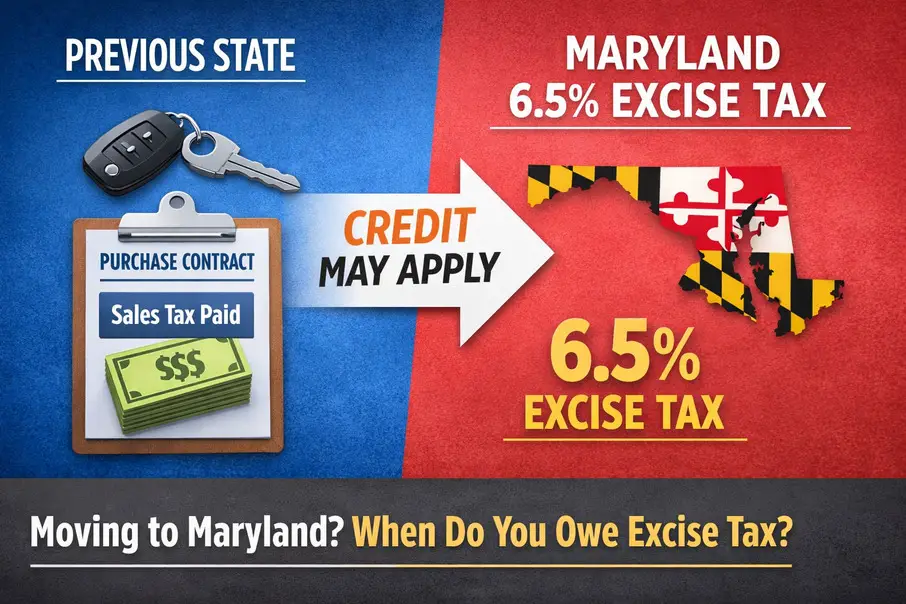

Maryland charges a 6.5% vehicle excise tax, and they apply it to the higher of:

- the price you say you paid (title or bill of sale), or

- the MVA’s internal “book value.”

If your price is lower than what the state thinks the car is worth, they’re going to want proof. A notarized bill of sale is that proof. It’s the difference between “okay, we’ll use your number” and “we’re going to tax you on the higher value.”

What the MVA Means by “Book Value”

Maryland doesn’t use Kelley Blue Book My Car’s Value for this. The MVA uses the NADA/J.D. Power valuation data — the same stuff dealers and the state look at for average retail pricing.

That’s the number they compare your sale price to. If you paid a lot less than that, they’ll want it notarized.

You can point customers to the MVA’s own calculator here: MVA Vehicle Excise Tax Calculator

That tool gives a close estimate of the value the MVA will use. If your price is more than $500 below that — and the car is under 7 years — get the bill of sale notarized.

MES Tip

When in doubt, notarize it. It’s cheaper than making another trip or paying tax on the higher value.

Bring your title, bill of sale, and buyer/seller info to Maryland Express Services, and we’ll tell you right away if the MVA is likely to ask for the notarized form.

Need hours or directions? Visit our contact page or call (443) 826-7843.

Frequently Asked Questions

1. Can I handwrite a bill of sale?

You can, but if the vehicle is under 7 years and the price is low, the MVA prefers the official Form VR-181 because it has every field they want — and it has a spot for the notary.

2. Does it always have to be notarized?

No. It has to be notarized when the vehicle is less than 7 years old, and the sale price is $500 or more below book value, and you want the MVA to honor that lower price. In other cases, a signed bill of sale is just good documentation.

3. What if the title doesn’t show the sale price?

Then use a bill of sale. The MVA needs something that shows the amount. A title with no price + no bill of sale makes the MVA default to their value.

4. What happens if we “lowball” the sale price to save tax?

The MVA will ignore it and use their book value. A notarized bill of sale with a realistic price is the safest way to go.

5. What’s this 6.5% tax again?

Maryland charges a 6.5% vehicle excise tax on the higher of (a) your sale price or (b) the MVA’s book value. That’s why paperwork matters — it affects what you pay.

Next Steps

Sources:

- Maryland MVA — Title & Registration Information

- Maryland MVA — FAQs

- Maryland MVA — Fees

- Maryland Excise Titling Tax

Maryland Express Services (MES) — Ellicott City, MD