If you’re using a vehicle for business and you work around DC, you’ve probably felt this pain: you park where you should be allowed to park, and the meter maid hits you with the “passenger plates don’t belong here” treatment.

So you start thinking:

“Let me put the vehicle under my LLC.”

Smart move — but Maryland doesn’t let you do it casually. There’s a tax reality, an inspection reality, and a “commercial plates are what DC actually respects” reality.

This guide explains the whole thing in plain English — no bureaucratic fog, no vibes-only advice.

Quick Answers (for people who don’t have time)

Do you pay Maryland excise tax when transferring a vehicle from your name to your LLC?

Usually, yes. Maryland generally treats you and your LLC as separate legal owners.

Is a Maryland Safety Inspection (MSI) required?

If you change BOTH title and registration to the LLC: yes, expect an MSI requirement in most normal cases for a used vehicle.

Will getting commercial plates help in DC “Commercial Vehicles Only” zones?

Yes — commercial plates are the main thing DC enforcement cares about. Not a USDOT number.

Do you need a USDOT number?

Usually no for local service businesses with typical cargo vans — and it won’t fix parking eligibility anyway.

Why Business Owners Do This (and why it’s not just “paperwork”)

People transfer vehicles to an LLC for a few real reasons:

- Liability separation (the old-school shield-and-sword approach)

- Insurance and claims clarity (business policy on business asset)

- Bookkeeping and deductions (cleaner accounting)

- Parking enforcement (especially DC zones that restrict passenger tags)

- Fleet growth (today one van, next year three)

And it’s not just trades. Here are common examples we see:

- Mobile detailing (chemicals, equipment, water tanks)

- Catering + food delivery (hot boxes, trays, event runs)

- IT field services (tool kits, ladder, server equipment)

- Event production (lighting, speakers, staging gear)

- Courier / medical delivery (route-based, time-sensitive)

- Home health agencies (staff transportation + supplies)

If the vehicle is part of how you earn, it should be treated like a business tool.

Step 1: Is Your “Work Vehicle” Considered Commercial in Maryland?

In practice, commercial status is driven by registration and use.

If the vehicle is:

- used for business

- owned/insured under an LLC

- carrying equipment or goods for work

- operating as part of day-to-day business activity

…it’s going to be treated as commercial for registration purposes.

A cargo van used for business is a classic commercial setup. Even if it looks “normal,” Maryland and DC both take cues from your plate class and registration type.

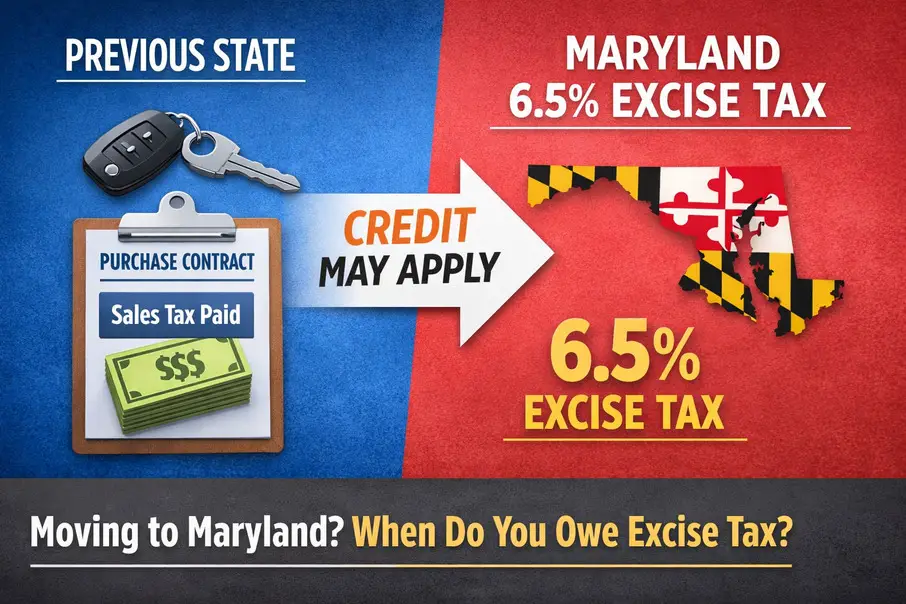

Step 2: The Tax Truth (Maryland Excise Tax)

Here’s the line in the sand:

“But I own the LLC… it’s basically me.”

Maryland says: Nope.

Your LLC is its own legal person.

So an individual → LLC transfer is generally treated like a taxable transfer unless a narrow exemption applies.

What you should expect

- Maryland excise tax is usually due

- It’s typically based on vehicle value (Maryland uses its own valuation method)

Bottom line: Plan like tax will be owed. If it turns out there’s a valid exemption for a special scenario, great — but don’t build your plan on unicorns.

Step 3: The Inspection Reality (MSI)

This is where people get tripped up — because they confuse “retitling” with “retitling + registering.”

If you are changing BOTH title and registration to the LLC:

✅ Expect a Maryland Safety Inspection requirement for a used vehicle in most normal transfers.

Why?

Because Maryland treats it like a new ownership registration event, not just a clerical correction.

Common “gotchas” that trigger inspection

- switching from personal to business registration

- switching plates into the LLC name

- changing owner type (individual → business entity)

Practical advice: If the plan is “new title + new registration to the LLC,” just assume MSI is part of the deal and move accordingly.

Step 4: The DC Parking Issue (What Actually Stops Tickets)

This is the heart of your client’s pain.

DC commercial-only parking isn’t impressed by:

- “It’s for work”

- a ladder rack

- tools inside

- your business card

- a USDOT number

What DC enforcement looks at first

✅ Plate class and registration type

If it’s wearing passenger tags, DC enforcement often treats it as passenger — even if it’s doing business all day.

DC-friendly setup (the practical recipe)

- Maryland commercial plates

- Registration and insurance aligned to business use

- Visible business markings (recommended, often helpful in enforcement situations)

Markings tip:

Simple vinyl lettering works. No wrap needed. Old-school, clean, effective.

- Business name on both sides

- Phone number optional but smart

- Legible from a few steps away

This isn’t about looking fancy. It’s about avoiding tickets.

Step 5: Do You Need a USDOT Number? (Usually No — and it won’t fix parking)

A USDOT number is about federal motor carrier oversight, not parking permissions.

You might need a USDOT number if:

- you operate interstate

- and the vehicle meets certain federal thresholds (often tied to weight/GVWR or regulated transport)

Most local service businesses do NOT need it:

- mobile detailing

- catering deliveries

- IT field service

- event production runs

- local courier work in light vehicles

And even if you did have one:

It does not magically convert passenger plates into commercial plates.

So it doesn’t solve DC parking eligibility.

Step 6: Maryland Commercial Weight Class (How to pick the right one)

Maryland commercial registration uses weight classes. For most business cargo vans, the “normal” class is the light commercial category.

What matters most

- Your vehicle’s GVWR

- Your intended use

- Whether you’re registering as commercial in the LLC name

Do not overstate weight just to “sound commercial.” It can raise fees and create unwanted attention.

If you want the cleanest answer every time:

- confirm the GVWR from the door jamb sticker (or manufacturer spec sheet)

- register to the appropriate commercial class based on that

Can You Get Personalized (Vanity) Plates on a Work Vehicle?

Sometimes — depends on registration class and plate program eligibility.

A lot of business owners want vanity plates for branding (totally fair), but commercial class eligibility can be stricter than passenger vehicles.

Best practice: Decide priorities in this order:

- Legal/compliance + DC usability (commercial plates)

- Correct weight class

- Then explore vanity options if the class allows it

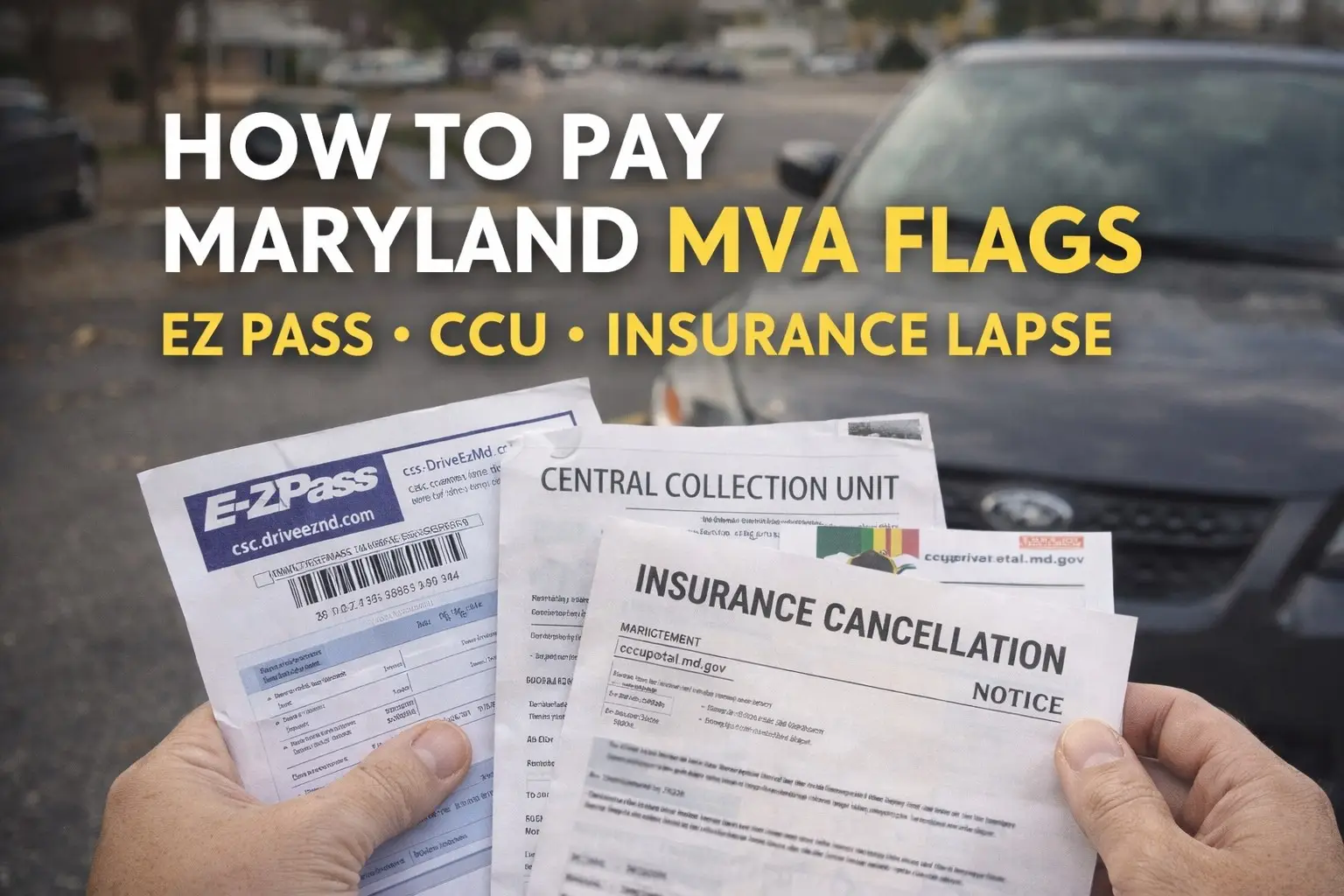

Common Mistakes That Get People Burned

- Trying to solve DC parking with a USDOT number

- Leaving insurance personal while titling to an LLC

- Assuming “already MD titled” means “no inspection ever”

- Picking the wrong weight class

- No business markings, then arguing with enforcement (spoiler: enforcement wins)

What MES Can Help With

If you’re transferring a work vehicle to your LLC, we can help you:

- confirm the correct path for title + registration

- prepare clean document packages

- avoid rejected transactions

- align plates/registration so DC parking rules stop being a weekly tax on your sanity

Before diving into the most common questions we hear from business owners, it’s worth grounding this topic in how Maryland and Washington, DC actually apply these rules in practice. The Maryland Motor Vehicle Administration sets the baseline for title, registration, excise tax, and when a Maryland Safety Inspection Certificate is required for used vehicles, but those guidelines don’t always account for real-world business use. That’s where confusion often starts—especially for companies operating across state lines. In Washington, DC, commercial vehicle parking rules are enforced primarily based on plate type and registration status, not federal identifiers or verbal explanations, as outlined by the District Department of Transportation. Because of this, getting the title, registration, and plate classification right from the beginning is critical. The questions below address the scenarios we see most often when clients work with Maryland Express Services for Maryland Tag & Title Services and business vehicle registration in Maryland, and they reflect the issues that most commonly lead to delays, rejections, or avoidable parking fines.

FAQ

If the vehicle is already titled in Maryland, do I still need inspection to move it to my LLC?

If you’re changing both title and registration to a new owner (the LLC), expect MSI in most standard used-vehicle cases.

Does commercial registration automatically mean I can park in DC commercial zones?

It dramatically improves eligibility, especially when paired with clear business markings — but always follow posted restrictions (hours, zone limits, loading rules).

Is this worth doing if I only go to DC once in a while?

If they ticket you once, you’ll understand why people do it. If you never park in restricted zones, you might not need the hassle.

Will putting the vehicle in the LLC reduce taxes?

Usually no. For most normal transfers, tax is owed.

Disclaimer

This article is for general informational purposes only and is not legal or tax advice. Requirements can vary depending on vehicle type, registration class, and how the vehicle is titled/registered. For official determinations, consult the Maryland MVA and applicable DC parking rules.